What to Expect from This Market as for Policies, Prices, and Trends

Neodymium magnets are the strongest and most affordable type of rare earth magnets. They were invented in the 1980s. They are made of an alloy of neodymium, iron, and boron (Nd2Fe14B), sometimes abbreviated as NIB. Unlike electrical magnets, they produce their own magnetic fields, which can provide greater magnet power in vastly smaller sizes. This is how, for example, we can make computers smaller and smaller as years go by.

Neodymium magnets are used in numerous applications requiring strong, compact, permanent magnets, such as electric generators for wind turbines, electric motors for cordless tools, electrical power steering, erase heads for cheap cassette recorders. But they are also used for loudspeakers and headphones, hard disk drives, magnetic hold-downs, mechanical e-cigarette firing switches, magnetic bearings and couplings, benchtop NMR spectrometers, and jewelry clasps. Besides, the higher magnetic field strength of neodymium magnets has inspired new applications in areas where magnets were not used before, such as magnetic jewelry clasps, children’s magnetic building sets, and other neodymium magnet toys.

Rare earth is the most critical element to neodymium magnets, and rare earth price decides their final price.” Pen song, a neodymium magnets company CEO said.

The graph here above outlines the distribution of rare earth element (REE) consumption worldwide in 2016 by end use. In that year, permanent magnets accounted for the most significant share of REE consumption, standing at 24 percent. China is expected to be responsible for the most significant share of global rare earth production.

This above statistic illustrates the estimated global rare earth reserves by country in 2017. The worldwide reserves of rare earth are approximately 120 million metric tons. Most of these reserves are located within China and believed to be around 44 million metric tons. The United States also own significant reserves, which are estimated to be some 1.4 million metric tons. In addition, within the major rare earth, holding countries are India, Australia, Brazil, and Malaysia. With 100 thousand metric tons produced from mines in 2016, China by far exploited most of its rare earth reserves.

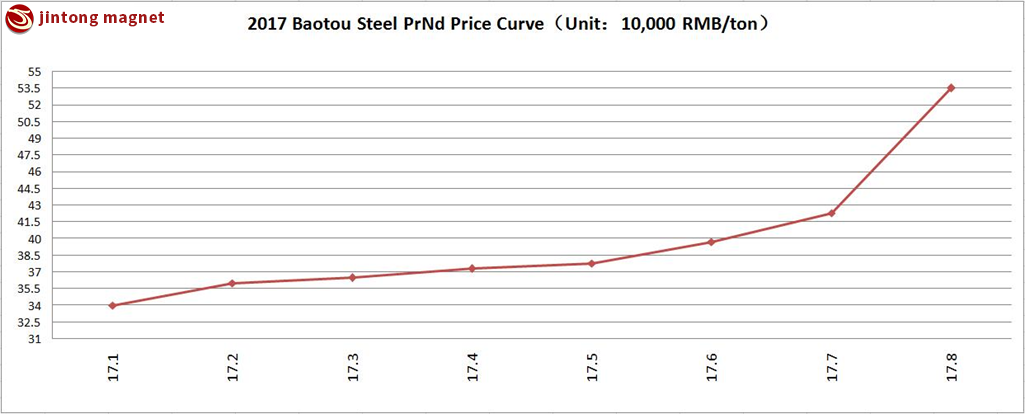

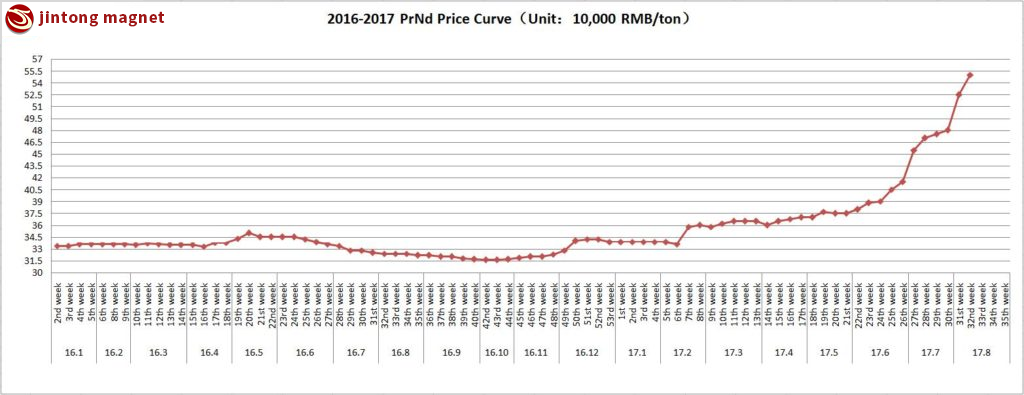

As for owing the enormous amount of rare earth reserves, China is the wind vane rare earth market. As the chart below shows, the price of the rare earth has increased dramatically since February 2017. This shift has contributed to the soar in global rare earth production costs.

There are two reasons why the increase was so quick: supply reduction and increase in demand.

Supply reduction

Firstly, in November 2016 the Chinese government implemented the “Purchasing and Storage Mechanism” policy for rare earth materials. The Chinese government fears that if the current poor mining practices and lack of regulation continue, China will “become a rare-earth poor country or even a country without rare earth elements.”

Xu Guangxian, China’s “Father of Rare Earths,” has been pushing China to build up its strategic reserves of rare earth. Xu continually warns about depleting rare earth reserves from overproduction. Stockpiling rare earth elements will allow China to better regulate the pricing of rare earth as well as help ensure its own future supplies.

Secondly, the Chinese Environmental Protection Department continuously strikes “black” rare earth mines and supervises legal excavations more strictly. A major concern surrounding China’s practice of mining rare earth elements is the negative impact it has on the environment due to lax mining practices. There are many potential environmental implications to mining rare earth elements if not done correctly. Pursuing the revenue potential, many rare earth mines have exacerbated the problem by operating illegally, without any regulations, and thus causing severe environmental hazards.

Increase in demand

First of all, the Chinese government believes that “Domestic consumption is a priority”. With 1.3 billion people and the fastest growing economy in the world, China is faced with the challenging task of ensuring it has adequate natural resources to sustain economic growth. On the other end, it also needs to appease the international community, which has been protesting against China’s cuts in rare earth export quotas. The use of solar and wind power is expected to increase exponentially in China in the next few years. Green energy technology is expected to become the largest consumer of rare earth elements in the future.

Secondly, due to the quick development of HEV (Hybrid Electric Vehicle), the consumption of rare earth magnets is rising; market forecasts predict a minimum 10% annual increase until 2020. With the development of tech products, China’s rare earth is of higher significance to the world. With so much emphasis placed on rare earth elements in modern-day technology, maintaining strict control over this resource will help to propel China into a position of greater political, economic, and military power.

Thirdly, political relations play a significant role in the distribution of these commodities. Magnetic technology rates are the most crucial use of rare earth elements due to their many applications in the energy and military sectors.

In 2018, the US President Donald Trump proposed tariffs on technology products imported from China. As a result, China immediately responded with tariffs on US goods. Were the Chinese to impose sanctions on these elements — just like what happened with Japan in 2010 — the US technology sector would be greatly harmed. US companies, such as Apple and Boeing, employ the materials and labor from China, and a significant part of their profits come from China’s vast market.

China currently restricts export quotas on dysprosium, terbium, thulium, lutetium, yttrium, and the heavy and scarcer rare earth. This reduction of export quotas has pushed up the international price of vital rare earth, including neodymium, which is so critical for the neodymium-iron-boron permanent magnets.

For neodymium magnets manufacturer, the increased price of raw materials can become a considerable challenge. A possible and feasible solution is to import rare-earth magnets directly from China.

Be the first to comment on "Neodymium Magnets Market Analysis & Forecasts"